LockTrust Core Banking System (SaaS)

Modular. Scalable. Secure. Built for the Future of Finance.

At LockTrust, we believe in delivering more than just banking software – we deliver a complete modular core banking engine designed to power innovation, speed, and service excellence. With our cloud-native, SaaS-based Core Banking System, financial institutions can launch, customize, and scale with agility – no legacy bottlenecks, no compromises.

We can shape your vision

Global - Native Architecture

Built on modern microservices for maximum reliability, performance, and real-time processing.

Customer & Account Management

Centralized system for onboarding, KYC, multi-currency accounts, and 360° customer views.

Deposit & Lending Modules

Flexible configuration for savings, checking, fixed deposits, personal and business loans.

Real-Time Transaction Engine

Instant processing of deposits, withdrawals, transfers, payments, and interbank transactions.

Automated Reconciliations & Settlement

Reduce manual work with auto-balancing and daily settlement workflows.

Regulatory Compliance Tools

Stay compliant with AML, KYC, and local/global banking regulations, fully auditable.

API Integration

Seamlessly connect your website, POS, or mobile app. Accept payments and sync transactions in real time.

Role-Based Access Control

Advanced permissions for teller, branch, admin, auditor, and partner access.

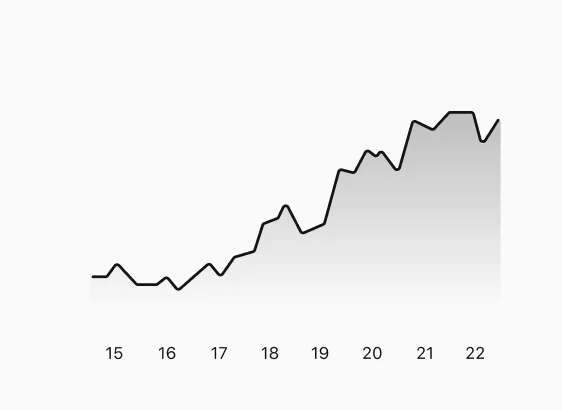

Modern Banking Infrastructure

Our SaaS-based Core Banking System empowers banks, credit unions, neobanks, and fintechs to manage their core financial operations with unprecedented speed, agility, and scalability. Hosted securely in the cloud, our platform eliminates the need for costly infrastructure, complex upgrades, and rigid legacy systems – while unlocking innovation and growth.

Launch new banking products or digital services in days—not months.

Say goodbye to hardware investments, maintenance, and expensive on-premise upgrades.

Grow from local community banking to global fintech reach without switching systems

Automatic updates ensure you’re always aligned with evolving financial regulations.

99.99% uptime architecture with disaster recovery and real-time backups.

Who Is It For

We prioritize top-tier customer experience. LockTrust’s mobile apps put real-time financial information directly into the hands of your users, empowering them to monitor, transact, and manage accounts on the go. From account statements to payments, everything is just a tap away.

- Digital Banks

- Fintech Companies

- Lending Institutions

- Governments

- Credit Unions

- Cooperative Banks

- Payment Service Providers

- Merchant Networks

Fueling Business Through Smarter Payments

Card Issuance & Virtual Wallets

Treasury & FX Management

Agency & Branchless Banking

Merchant Payments & POS

Loan Origination & Credit Scoring

Open Banking & PSD2 Readiness

Core Banking System

Fueling Business Through Smarter Payments

Secure Payments

PCI-DSS-compliant infrastructure

Rapid Customization

Tailored deployments that fit your operations

Modular Flexibility

Only pay for the features you use

Global-Ready

Multi-currency, multi-language, and localization support

Real-Time Insights

Always-on access to financial and customer data

Always Evolving

Regular updates, compliance patches, and performance upgrades

Built for Flexibility

Modular Core for Rapid Customization

LockTrust’s Core Banking System is a module-driven engine, enabling rapid deployment and deep customization for each client – whether you’re a neobank, credit union, fintech startup, or microfinance provider. Our flexible architecture means we can tailor solutions to your specific workflow in record time.

Launch Smarter. Scale Faster. Serve Better.

Whether you’re building a digital-first bank or upgrading legacy operations, LockTrust gives you the tools to lead with confidence. From virtual terminals to mobile apps, everything is connected – securely, simply, and in real time.