Empowering Digital Payments in Developing Economies

LockTrust is a secure, scalable SaaS platform designed to transform how individuals, businesses, and governments in emerging markets manage and move money. With a focus on accessibility, regulatory compliance, and financial inclusion, LockTrust bridges the gap between traditional financial systems and the mobile-first future.

What Sets LockTrust Apart

Scalable, Secure SaaS Payments Platform

LockTrust was built for economies where access, trust, and flexibility are critical. Our platform simplifies digital payments, supports local currencies and mobile money, and connects governments, financial institutions, and agents to accelerate digital transformation.

Multi-rail support

Mobile money, bank accounts, cash-in/cash-out, QR

Agent banking ready

Empower rural & unbanked users through local agents

Merchant & Utility Payments

Allow users to pay for goods, bills, and services seamlessly using e-wallets, cards, or mobile money.

Bulk Disbursements

e.g., payroll, aid, stipends

Cross-border Transfers & FX Settlements

International settlements with FX handling

Easy to deploy, easy to scale

Cloud-native SaaS with modular APIs

Only 57% of Adults in Developing Economies Make Digital Payments

— World Bank, 2021

Leaving significant room for growth, especially among women and rural populations.

1.4 Billion Adults Are Unbanked

— World Bank Global Findex 2021

Most live in developing economies and rely on cash or informal services, particularly for daily purchases, transport, and small business payments.

Cash Still Dominates in 80% of Transactions

— IMF and IFC studies

Emerging Market Realities We Solve

LockTrust combines global-grade infrastructure with deep local understanding. Whether you’re a fintech startup, NGO, bank, or government agency, we help you deploy rapidly, scale securely, and serve users efficiently – even in low-connectivity or cash-heavy environments.

Built for Reality. Designed for Growth.

- Reduce poverty by expanding access to finance

- Increase GDP and entrepreneurial opportunity

- Make governments more efficient and accountable

- Drive innovation and cross-sector growth

The shift to digital payments isn’t just about convenience

- It’s about empowerment.

Built for Impact

Financial Inclusion

Deliver services to the unbanked and underserved through mobile-first solutions, agent networks, and digital wallets.

Economic Empowerment

Equip small merchants, freelancers, and informal workers with the tools to grow, accept payments, and access credit.

Transparent Government Payments

Disburse pensions, aid, and subsidies securely with full audit trails.

Resilience & Scale

From rural villages to megacities, our platform supports growth with offline modes, agent-based models, and multilingual UX.

Let’s make digital finance accessible for all.

Join a growing ecosystem of innovators driving financial empowerment in developing economies. Our APIs, sandbox environments, and onboarding support make integration easy.

- Fintechs & Startups

- Governments & NGOs

- Banks & MFIs

- Merchants & Utilities

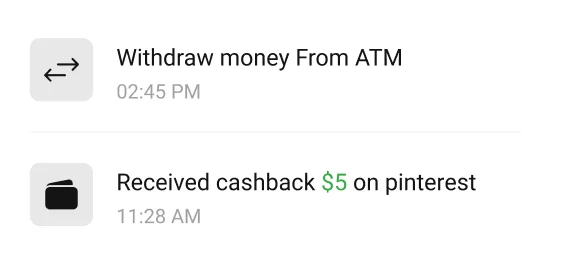

SaaS Empowers institutions. eWallet Empowers the People.

Even in places where banks are miles away, our wallet lets people receive money, pay for services, and build their financial future - all from their phone.

Our e-wallet perfectly complements our SaaS & EMS platforms by enabling people in underserved or remote areas – especially those without access to traditional banks – to create & manage digital bank accounts. This is a vital step toward true financial inclusion.

While our SaaS & EMS solutions empower institutions to distribute payments & services efficiently, the e-wallet empowers everyday people to receive & use those funds – whether for goods, services, or essential needs.

Drive Local Development

Strengthens public-private collaboration in key sectors

Marketplace

A flexible SaaS platform built to digitize buying, selling, and service exchange across emerging markets. From informal street vendors to small-scale manufacturers, our solution helps unlock new income streams, boost financial inclusion, and scale local economies.

Education

More communication than what scalable, cloud-based education platform built to address the challenges of learning in developing economies. Whether you're a school, university, training center, or NGO, we empower you to deliver quality education anytime, anywhere, even in low-resource environments.

Rideshare & Gig Economy

enables entrepreneurs, governments, and transport unions to launch and scale ride-hailing services in emerging markets. Designed for low-bandwidth, cash-based, and mobile-first ecosystems, it connects passengers with trusted local drivers -anywhere, anytime.

Residential & Commercial

Construction and real estate digitization are more than just modern conveniences - they are core enablers of economic mobility, infrastructure development, and urban resilience.

Social

Empower people in developing economies to connect, share, organize, and grow -digitally and securely. Whether it’s building local networks, launching interest-based groups, or creating impact-driven communities, LockTrust brings meaningful digital inclusion to the world’s underserved.

Travel

Power transportation, tourism, and local mobility in developing economies. We connect travelers, operators, and service providers on a single digital platform, making it easier, safer, and more efficient to move people and promote destinations.

LockTrust SaaS isn’t just software -

It’s infrastructure for digital inclusion, growth, and resilience.

Join a growing ecosystem of innovators driving financial empowerment in developing economies.

Whether you’re connecting rural farmers, enabling migrant workers to send remittances, or powering local fintechs—LockTrust is your foundation for trustworthy, inclusive financial services.