Power Seamless Payments Under Your Brand!

Deliver a fully branded digital payment experience without the complexity of building from scratch. Our white-labeled Payment Gateway SaaS empowers you to launch, scale, and manage a complete payments infrastructure — all under your own name.

All Technology Available for White Label

Capabilities via Lock Trust Ecosystem

Core Banking & Modular Platforms

API- and module-based banking engine with features such as batch uploads, virtual terminals, invoice systems, and detailed transaction archiving – all customizable per client.

Advanced Fraud & Security

PCI-DSS Level 1 compliant, incorporates end-to-end encryption, real-time fraud detection, biometric & two-factor authentication (2FA). Built into the wallet & underlying SaaS solution with configurable fraud rules.

AI-Powered Finance Tools & Integrations

Access features like automated patented tax collection, risk monitoring, treasury services, lending modules, and full ERP integration – under a single SaaS umbrella.

We offer Branded Payment Platform.

Whether you’re a fintech, SaaS provider, ISO, or enterprise platform, our white-labeled payment gateway gives you the infrastructure to deliver secure, scalable payment solutions — all under your brand.

Escrow Services & Milestone Payments

Facilitate secure peer-to-peer transactions, purchases, or services using patented escrow technology -holding & releasing funds based on defined milestones.

Virtual Terminals & POS Support

Accept card‑not‑present payments via web-based virtual terminals for MOTO/email/phone orders, plus POS systems for in-person transactions.

Frictionless Checkout Solutions

Mobile-optimized, customizable checkout pages, support for one-click saved cards & multi-language UX with branding, automated reminders, & easy payment reconcile.

Multi‑Currency & Global Payments

Support for 135+ currencies and local payment methods, with real-time FX conversions for smooth cross-border processing

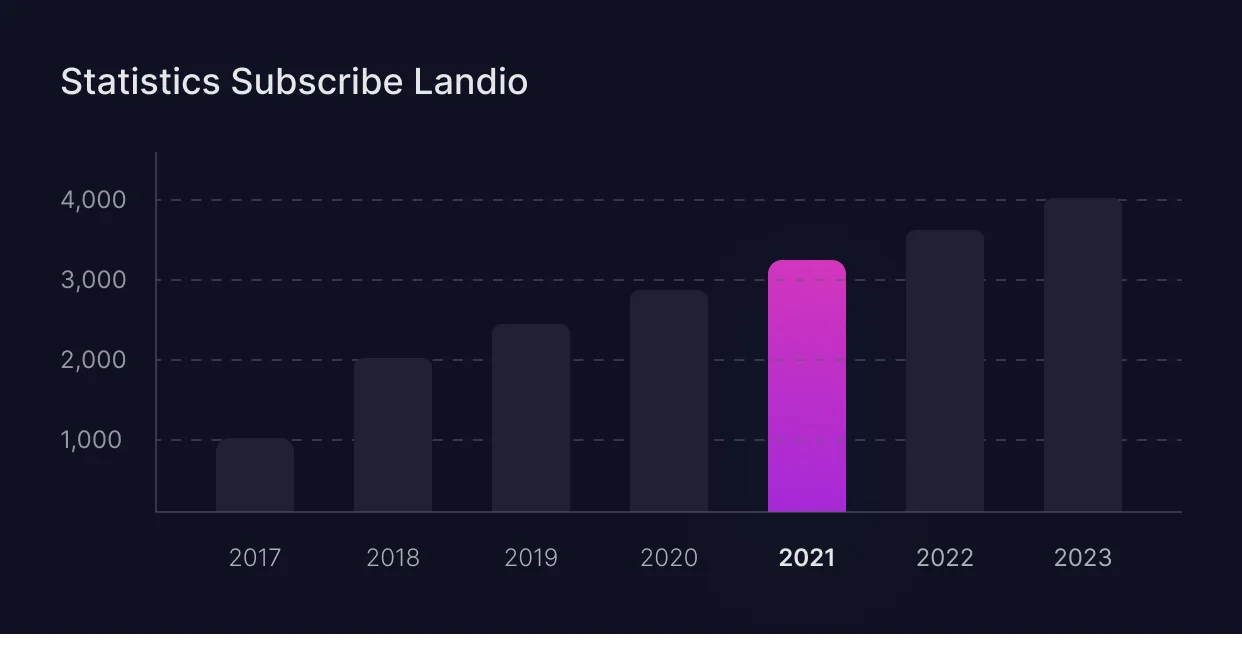

Recurring Billing, Invoicing, & Subscriptions

Built-in billing cycles subscription engine handling plans, prorations, & automated payouts with smart invoicing tools – ideal for SaaS, memberships, & recurring services.

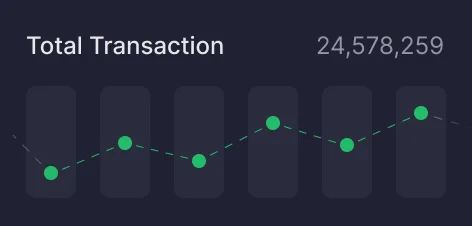

Real-Time Payments & Transfers

Supports wallet-to-wallet and bank transfers using FedNow and Real-Time Payments (RTP) in the U.S., allowing instant 24/7 transfers.

Revenue Expansion

Set and control your own fees, enable value-added services, and unlock new revenue streams.

Complete Brand Control

Your logo, your customer journey. Seamlessly embed payments into your existing user experience.

Faster Time to Market

Deploy your branded payment solution in weeks, not months.

Built for Businesses Who Want to Own the Payment Experience

Today’s leading platforms are taking payments in-house — increasing revenue, improving user retention, and enhancing customer trust. Our white-labeled payment gateway lets you do the same, with a turnkey solution designed for B2B scalability.

Lock Trust

We Understand Your Needs

Whether you’re a fintech, SaaS provider, ISO, or enterprise platform, our white-labeled software suite gives you the infrastructure to deliver secure, scalable payment solutions – all under your brand.

Blockchain

Digital Data Storage

DeFi (Decentralized Finance)

Blockchain-based Finance Solutions

NFT (Non Fungible Token)

Enterprise-Grade Security

PCI-DSS Level 1 certified. We handle fraud detection, KYC/AML, & data protection – so you stay secure.

Full Merchant Management Suite

Onboard, monitor, and manage from an intuitive back office. Offer custom pricing, transaction reports, & settlement tools.

Global Connectivity

Easily integrates with acquiring banks, third-party gateways, and PSPs worldwide to reach new markets quickly.

Flexible Integration

API-first architecture & ready-to-use SDKs make it easy to integrate with your existing systems, mobile apps, or websites.

Reliability

With platform uptime around 99.999% – we stay open 24/7. Ideal for global operations with enterprise-level support.

White Labeled Solutions

Optimized For

Fintech Startups

SaaS Platforms

Marketplaces

Large Enterprises Seeking In-House Payments Control

Digital Banks & Wallets

ISOs & Payment Facilitators

Component Features.

Our platform is built for scale, with redundant uptime, global compliance protocols, and ongoing updates to meet evolving regulations — so you can focus on growth, not maintenance.

LT Wallet

- Multi-Account Management

- Real-Time Payments (Fednow/RTP)

- Virtual Cards

- Bill Payment

- Escrow

- Invoicing

- Automation Features

LT Payment Gateway

- White-Label PSP Launch

- Multi-currency Global Processing

- Invoicing

- Virtual Terminal

- POS

- Recurring Billing

- Fast Settlements

- Fraud Protection

Enterprise Modules

- Core Banking Engine

- Batch/Bulk Payments

- AI-Driven Finance Tools

- Travel Apps

- Medical HIPPA Compliant Apps

- Marketplace Apps

- & Many More CRM - ERP Apps

White Labeled SaaS

Software as a Service

Lock Trust’s SaaS platform gives banks and credit unions everything they need to compete – and win – in today’s digital-first world. From wallets, payment gateways, and card management to treasury, lending, asset management, and advanced analytics, we’ve got you covered. Seamless risk management, online and mobile banking, and powerful branch tools keep you ahead of the curve – whether you’re a small community bank or a large financial institution.

We empower traditional brick‑and‑mortar banks to compete and thrive in an ever‑evolving market.

The Most Advanced Banking Technology on the market today, with more apps at less cost!

Give clients a professional experience under your brand with fully customizable UI with your branding

Credit/debit cards, bank transfers, e-wallets, QR codes, ACH & more

Store card data securely for one-click payments

RESTful APIs, Webhooks, SDKs for quick deployment. Integrate only what you need — payment APIs, KYC modules, invoicing, etc.

Streamline partner signups and automate compliance checks that let your clients sign up and start accepting payments instantly.

Simplify chargebacks and customer disputes

Set transaction fees, settlement delays, and payout logic per client

Recurring payments, smart invoicing, and plan management.

Ideal for corporate and government use-cases: schedule mass payouts, implement maker-checker flows, reverse or retry payments, and manage employee or beneficiary profiles from a centralized portal.

Ideal for marketplaces and platforms managing multiple parties

Manage internal teams, merchant users, and permission levels

Your Brand.

Our Infrastructure.

We provide the infrastructure – you retain the customer relationship, the data, and the brand visibility. Whether you’re launching a fintech product or looking to expand your platform’s capabilities, our white-labeled solution delivers unmatched speed to market and enterprise-grade reliability.

Frequently Asked Questions

Couldn’t find what you were looking for? Write to us at

info@locktrust.com

A payment gateway is the technology that enables businesses to accept online payments. It connects a customer’s payment method — like credit cards, digital wallets, or bank transfers — with the merchant’s account, securely transferring funds and authorizing transactions in real time.

It also helps encrypt sensitive data, verify transaction details, and protect against fraud — ensuring a secure and seamless checkout experience for customers.

Here’s how a payment gateway processes a transaction:

- Customer Checkout: A user enters their payment details on your site or app.

- Data Encryption: Information is encrypted and securely sent to the payment gateway.

- Routing: The gateway forwards the transaction to the processor and card network.

- Authorization: The customer’s bank verifies the request and approves or declines it.

- Response & Fulfillment: The result is sent back to your system. If approved, the order is fulfilled.

Settlement: The funds are transferred from the customer’s bank to your merchant account.

A white-labeled payment gateway is a fully developed payment infrastructure that you can rebrand and offer as your own. You get full control over the customer interface, logo, domain, and user experience — while we power the technology behind the scenes.

White-label gateways are ideal for:

- Ecommerce brands needing a branded, seamless checkout

- SaaS providers enabling in-app or recurring billing

- Banks & fintechs expanding digital offerings

- Marketplaces handling vendor payments and splits

- Startups & SMEs wanting to launch fast without high dev costs

Our clients include fintech startups, SaaS platforms, marketplaces, digital wallets, ISOs, and even traditional financial institutions looking to modernize their payment systems without the cost of building from scratch.

- Brand Control

Deliver a consistent, branded experience across your entire customer journey. - Faster Go-to-Market

Skip the complex development cycle and launch in weeks, not months. - Cost-Efficiency

Avoid high upfront investment and reduce maintenance overhead. - Security & Compliance

Leverage built-in PCI-DSS, fraud tools, and regulatory compliance — without managing it in-house. - Custom Integration

Connect your payment stack with internal systems (CRM, ERP, accounting) to streamline workflows and gain data visibility.

Yes — you have full control over your pricing model. Set transaction fees, subscription plans, setup costs, and even custom rates per merchant or partner.

Look for a solution that aligns with your technical, operational, and strategic goals. Key considerations include:

- Supported payment methods and geographies

- Customization and branding options

- Developer tools and API quality

- Compliance coverage and certifications

- Transparent pricing and SLAs

- Quality of customer support

Ask yourself:

- What’s the ideal experience I want to deliver?

- What payment flows or automations do I need?

How much control do I want over pricing, fees, or merchant onboarding?

Yes — our platform is API-first and comes with extensive documentation, SDKs, and sandbox environments for easy integration into your own systems or third-party applications.

We offer dedicated account management, technical support, onboarding assistance, and regular updates to ensure your platform runs smoothly and securely.

Yes — every aspect of the platform can be customized, including logos, colors, domains, dashboards, and customer portals. Your clients will only see your brand, not ours.

Most partners launch their branded payment solution within 2–6 weeks, depending on the level of customization and integrations needed.

Absolutely. A reputable white-label provider will ensure full PCI-DSS compliance, use strong encryption protocols, and offer tools for fraud detection, KYC/AML, and GDPR or PSD2 compliance — reducing your liability and ensuring customer trust.

Our platform is PCI-DSS Level 1 certified, with built-in KYC/AML workflows, encryption, fraud detection, and ongoing compliance updates. You get enterprise-grade security out of the box.

We support a wide range of global and local payment methods — including credit/debit cards, ACH, SEPA, wire transfers, e-wallets, QR codes, and more. You can enable or disable methods based on your market or client needs.

Yes. Our platform includes a powerful recurring billing engine, allowing you to support subscription-based business models with automated invoicing, retry logic, and reporting.

Yes — our platform is API-first and comes with extensive documentation, SDKs, and sandbox environments for easy integration into your own systems or third-party applications.

Yes. Accept payments globally, process in multiple currencies, and access real-time FX conversions — all within your branded platform.

Yes — you’ll have a full merchant management suite, including onboarding workflows, KYC automation, approval systems, payout schedules, and more.

We offer dedicated account management, technical support, onboarding assistance, and regular updates to ensure your platform runs smoothly and securely.