LendTrust

Micro Loan Management with Credit Score Integration

Our Micro Loan Management solution is built for financial institutions, fintechs, and cooperatives looking to streamline micro-lending operations while minimizing risk. With seamless credit score integration, you can make data-driven decisions, expand financial inclusion, and improve portfolio performance.

We provide the best Lending Solutions

Blockchain-Enabled Security

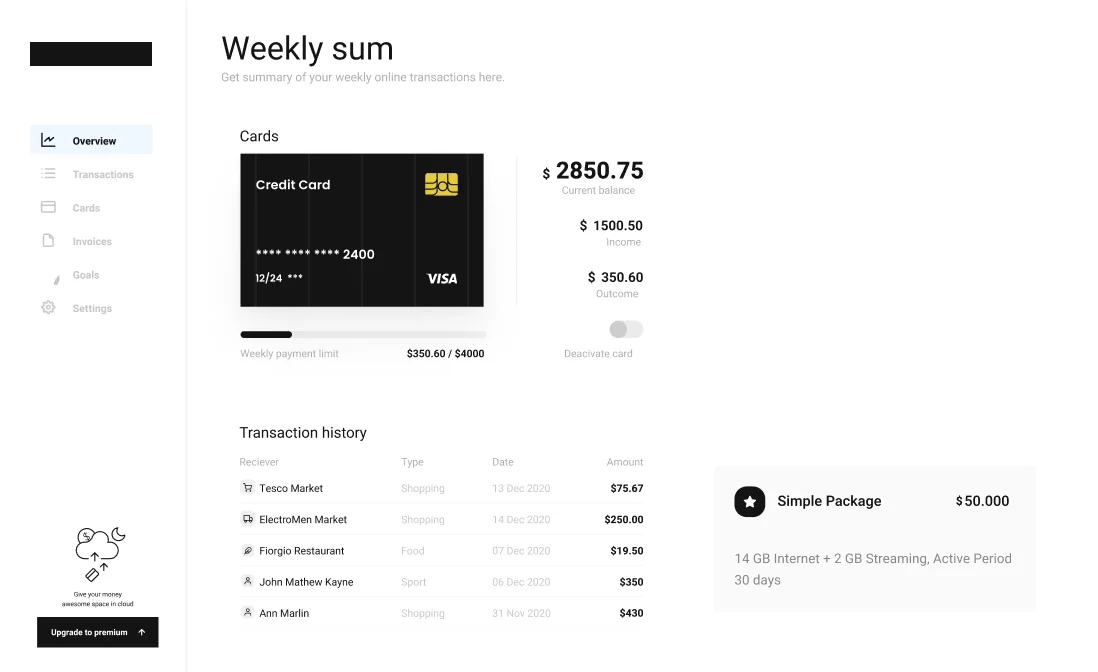

Analytics & Reporting

Digital Onboarding & KYC

Credit Score Integration

Lock trust Payment features

Flexible Loan Products

Support micro-loans, nano-loans, and tailored repayment schedules.

Automated Decisioning Engine

Accelerate lending with intelligent workflows and minimal manual intervention. Set parameters for approvals, limits, and interest rates based on credit insights.

Built-In Payment Triggers & Alerts

Stay ahead of repayment issues with automated reminders and smart triggers.

We Help Your Needs

Built for solo online lenders, mid-sized financial institutions, and fintech innovators, LendTrust delivers a seamless lending experience that scales with your business needs.

- Modular & Scalable Architecture

- Regulatory Compliance Updates

- Collections & Notifications

- Built-In Payment Triggers & Alerts

- End-to-End Loan Lifecycle Management

Benefits for you

LendTrust is an intelligent, automated platform designed to empower companies to extend credit to individuals and small businesses. Leveraging online lending, blockchain, social network scoring, mobile data analytics, and proprietary risk modeling, LendTrust drives financial inclusion across customer segments – including the underbanked and unbanked.

Faster Approvals

Reduce manual processes and approve loans in minutes.

Financial Inclusion

Serve underbanked communities with confidence.

Reduce Risk Exposure

Make smarter lending decisions with real-time data insights.

Future-Ready Platform

Integrates emerging tech like blockchain and AI analytics.

Reduced Operational Costs

Automate processes and cut down on paperwork.