Engineered for Speed. Built for Trust.

Minimize fraud, reduce chargebacks, and stay compliant with a comprehensive risk management solution designed for modern payments. Our system monitors every transaction in real time – so you can scale with confidence while keeping your platform and users safe.

Core Features

Chargeback Management

Identify high-risk transactions early and respond proactively to disputes with intelligent chargeback alerts and response tools.

Risk Scoring Engine

Assign dynamic risk scores to users and transactions based on real-time and historical data—automatically apply rules or escalate for manual review.

Fraud Detection & Prevention

Leverage AI-powered fraud models, velocity checks, geolocation, and behavioral analytics to flag unauthorized activity.

Adaptive Machine Learning

Your risk system improves with every transaction. Reduce false positives while identifying emerging fraud patterns quickly.

Global Compliance

Stay ahead of evolving regulations with built-in support for PCI-DSS, AML, PSD2, and regional KYC/KYB requirements.

Seamless Integration

Integrate with your infrastructure via APIs or prebuilt connectors—no disruption to your existing flow. Set risk thresholds, rules, and actions with full flexibility and control.

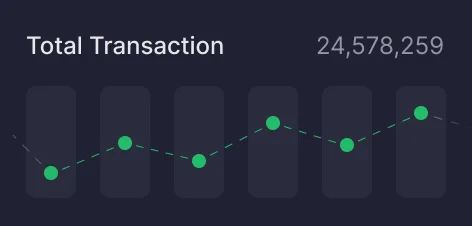

Real-Time Risk Monitoring

Every payment is analyzed instantly using advanced machine learning and rule-based engines to detect anomalies, suspicious behavior, or high-risk transactions – before they impact your bottom line.

Who It's For

- Payment Service Providers

Protect your merchants and your platform with enterprise-grade tools. - Marketplaces & Platforms

Manage seller risk, buyer fraud, and peer-to-peer trust efficiently. - SaaS & Subscription Businesses

Prevent account takeovers and repeated billing fraud. - Financial Institutions & Neobanks

Detect AML violations, synthetic identity fraud, and payment laundering in real time.

You’ll pay the normal merchant transaction fees. Fees and costs are subject to change.

Predictable Pricing. Proactive Protection.

Seller Protection

$0

NO ADDITIONAL FEE

For eligible LTPG payments transactions

Fraud Detection

$0

NO ADDITIONAL FEE

For eligible credit and debit card transactions

Chargeback Monitoring

0.30%

PER TRANSACTION

For eligible credit and debit card transactions

Why Choose Lock Trust

- Scalable to millions of transactions

- Transparent, customizable rules engine

- AI-driven risk scoring with human review workflows

- Actionable insights through detailed dashboards and reports

- 24/7 support and regulatory updates

Stay One Step Ahead of Payment Fraud

Fraudsters evolve. So do we.

Arm your business with the tools to detect, prevent, and respond to risk at every payment touchpoint.