Empower Financial Inclusion

with Our Agency Banking Platform

Seamlessly extend your banking services beyond branches. Onboard agents, process transactions securely, and grow your reach with our end-to-end agency banking software.

We can shape your vision

Agent Management Made Simple

Onboard, monitor, and manage agents across regions with powerful tools and real-time dashboards.

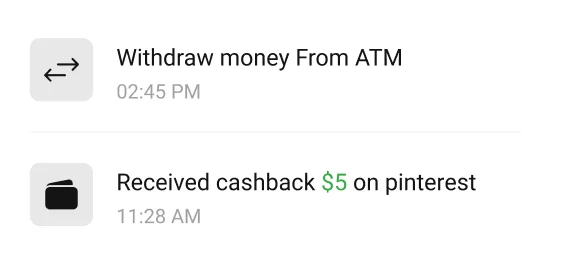

Secure Transactions

Ensure every cash-in, cash-out, payment, and transfer is processed with bank-grade security.

24/7 Service Availability

Keep your network running round-the-clock with high availability and robust infrastructure.

Regulatory Compliance

Built-in KYC, AML, and audit trails to meet all regulatory requirements.

Key Features

The Agency Banking solution broadens the horizon for banks to help them serve their customers efficiently. With this solution, banks can take their branch directly to customers and provide services at their doorsteps

Digital agent registration and verification workflows.

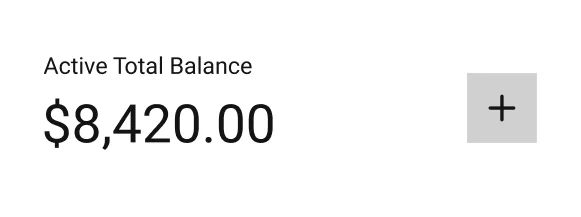

Track cash limits, settlements, and float balances in real time.

Automate agent commissions and configurable fee structures.

Enable deposits, withdrawals, utility bill payments, fund transfers, and more with affordable real time transactions.

Agents operate via mobile app or POS devices, while banks control from a secure portal.

Gain insights into agent performance, network growth, and customer engagement.

Our best service for your business development

Long Distance Remittances

Bridge the gap for families and businesses by enabling safe, affordable long-distance remittances. With our solution, customers can send and receive money across regions without needing to visit a traditional bank branch.

Send. Receive. Access Anywhere

Empower customers with the ability to deposit, withdraw, and send money – whether to banked or unbanked recipients – through a trusted agent network.

Loan Management

Enable seamless loan installment repayments by deducting directly from customers’ micro banking account balances – simplifying the process for both agents and account holders.

Flexible & Scalable Agent Network Access Points

With our solution, your agent network isn’t just a distribution channel - it becomes a strategic growth engine for financial inclusion.

Our platform enables banks & financial institutions to deploy a dynamic network of agents that act as secure, localized access points for customers. Whether operating in urban centers or remote rural areas, agents can deliver a full suite of banking services – deposits, withdrawals, transfers, bill payments, and account opening.

As your network grows, the system scales effortlessly, supporting thousands of agents, multiple locations, & diverse service offerings without compromising performance or security.

Geo-Fenced Operations

Configure agent services based on location and demographics.

Real-Time Monitoring

Track transactions, cash positions, and agent activity live.

Circulating cash within communities

Enabling small businesses to transact digitally

Creating jobs for agent entrepreneurs

Driving Financial Inclusion for the Unbanked & Boosting Local Economies

Billions worldwide remain unbanked or underbanked, excluded from formal financial systems. Our Agency Banking solution bridges this gap by transforming everyday shops, kiosks, and community outlets into micro-banking access points.

This not only improves access to finance but also stimulates local economic growth.

As the agent network expands, so does the reach of financial services—supporting government initiatives for financial inclusion, increasing GDP participation, and empowering individuals to save, invest, and grow.

essential banking services for unbanked communities

As the agent network expands, so does the reach of financial services—supporting government initiatives for financial inclusion, increasing GDP participation, and empowering individuals to save, invest, and grow.

Account opening

Deposits & withdrawals

Utility bill payments

Fund transfers & microloans

Who Is It For

- Banks & MFIs

- Fintech Companies

- Credit Unions & SACCOs

- Payment Service Providers

Benefits that you can feel immediately

Agency Banking empowers financial institutions to extend their services beyond traditional brick-and-mortar branches, enabling them to reach underserved and remote populations effectively.

Ensure Secure Transactions

Deliver bank-grade security and compliance through a robust digital platform.

Enable Data-Driven Growth

Gain insights into customer behavior and agent performance with real-time analytics.

Create Local Jobs

Empower individuals and small businesses to act as agents, stimulating local economies.

Reduce Operational Costs

Build a scalable network of agents without the high capital expenditure of physical branches