Escrow is a term often heard in real estate and financial transactions. But what does it really mean? At its core, escrow is a financial arrangement. It involves a neutral third party holding funds or assets until certain conditions are met.

This guide explores escrow in detail: its purpose, how it works, and why it’s important. Whether you’re buying a home, engaging in a business deal, or conducting online transactions, understanding escrow is crucial. LockTrust escrow services provide the security and peace of mind needed to complete transactions confidently.

What Is Escrow?

Escrow is a financial setup where a third party securely holds and manages funds or assets. This occurs until specific conditions set in an agreement are met by all parties.

In many cases, escrow accounts are pivotal in real estate deals. They protect both buyers and sellers by ensuring that agreed terms are completed before releasing the assets or funds. This intermediary role builds trust and reduces risk between the involved parties.

An escrow agent is the neutral party responsible for managing the escrow process. The agent ensures compliance with the agreement. This involves verifying documentation and securing funds for the transaction’s success.

Key aspects of escrow include:

- Neutrality: An unbiased third party handles funds.

- Security: Funds are protected until conditions are met.

- Accountability: Ensures transparency and fulfillment of agreements.

In essence, escrow provides a structured and secure framework for transactions. This security is why escrow is vital in many financial exchanges.

How Does Escrow Work?

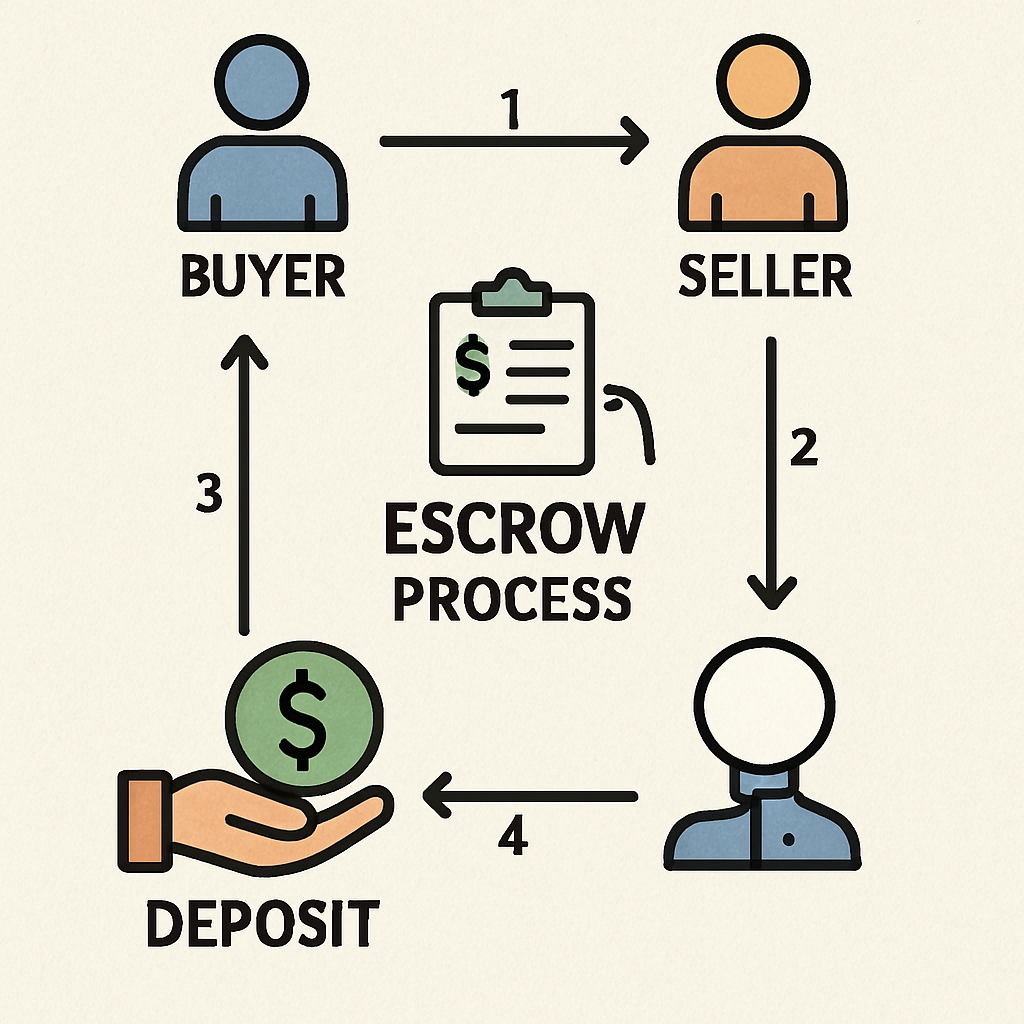

Escrow works by engaging a neutral party to ensure the safe handling of transaction elements. This includes funds, titles, and any necessary documents. The process begins when the buyer and seller reach an agreement on the transaction terms and sign a contract. This contract outlines all conditions that must be met before the exchange is finalized.

Once the agreement is set, the escrow agent steps in to manage the funds. The agent holds these in a secure account until all contractual conditions are satisfied by both parties. This security ensures that neither party bears undue risk before completion.

The escrow process involves several key steps:

- Agreement signing by both parties.

- Escrow agent collects funds and documents.

- Verification of all conditions and compliance.

- Release of funds upon fulfillment of terms.

Throughout the process, communication between the escrow agent and parties is maintained to ensure transparency and trust. The structured nature of escrow ultimately facilitates a secure and reliable transaction environment.

The Role of Escrow Services in Real Estate

Escrow services play a crucial role in real estate transactions. They ensure both buyer and seller meet all agreed conditions before a sale is finalized. Escrow acts as a safeguard, holding earnest money deposits and other key documents.

In real estate, the escrow process begins after the buyer and seller sign a purchase agreement. Here, the escrow agent secures deposits and monitors obligations. This step is critical to address any potential disputes or misunderstandings.

The responsibilities of escrow services in real estate include:

- Holding earnest money deposits securely.

- Verifying the property title is clear.

- Ensuring all property taxes are settled.

- Managing document collection and distribution.

An escrow service ensures protection for all parties involved. It verifies there are no outstanding liens or debts on the property. This validation is vital for the buyer, confirming they are acquiring a clear title.

For sellers, escrow guarantees that buyer funds are legitimately secured. This assurance mitigates risks associated with financial transactions.

Escrow Agents: Duties and Responsibilities

Escrow agents serve as neutral third parties in transactions. Their main role is to manage funds and documents during the process. They ensure all contract terms are met before any funds are transferred.

Key duties of escrow agents include:

- Holding and disbursing money based on agreement terms.

- Ensuring all transaction conditions are satisfied.

- Managing and distributing necessary documents.

- Acting as mediators if disputes arise.

These agents play a significant role in safeguarding both buyers and sellers. They verify that transaction details are fulfilled as planned. Their presence adds an element of trust and helps prevent potential conflicts between parties.

Escrow Accounts: Types and Uses

Escrow accounts serve various purposes in financial transactions. They provide a secure place to manage funds until transaction terms are fulfilled. Different types of accounts cater to distinct needs.

Common types of escrow accounts include:

- Real Estate Escrow Accounts: Hold deposits and ensure taxes and insurance premiums are paid.

- Online Transaction Accounts: Protect buyers and sellers in internet sales.

- Construction Escrow Accounts: Manage payments to contractors as work progresses.

These accounts are crucial in managing funds securely. They prevent misuse until all parties meet their contractual obligations. By using escrow accounts, buyers and sellers gain confidence that conditions are properly managed. This helps streamline transactions across different sectors, mitigating risks and ensuring all involved parties abide by the agreed terms.

Escrow Process Step-by-Step

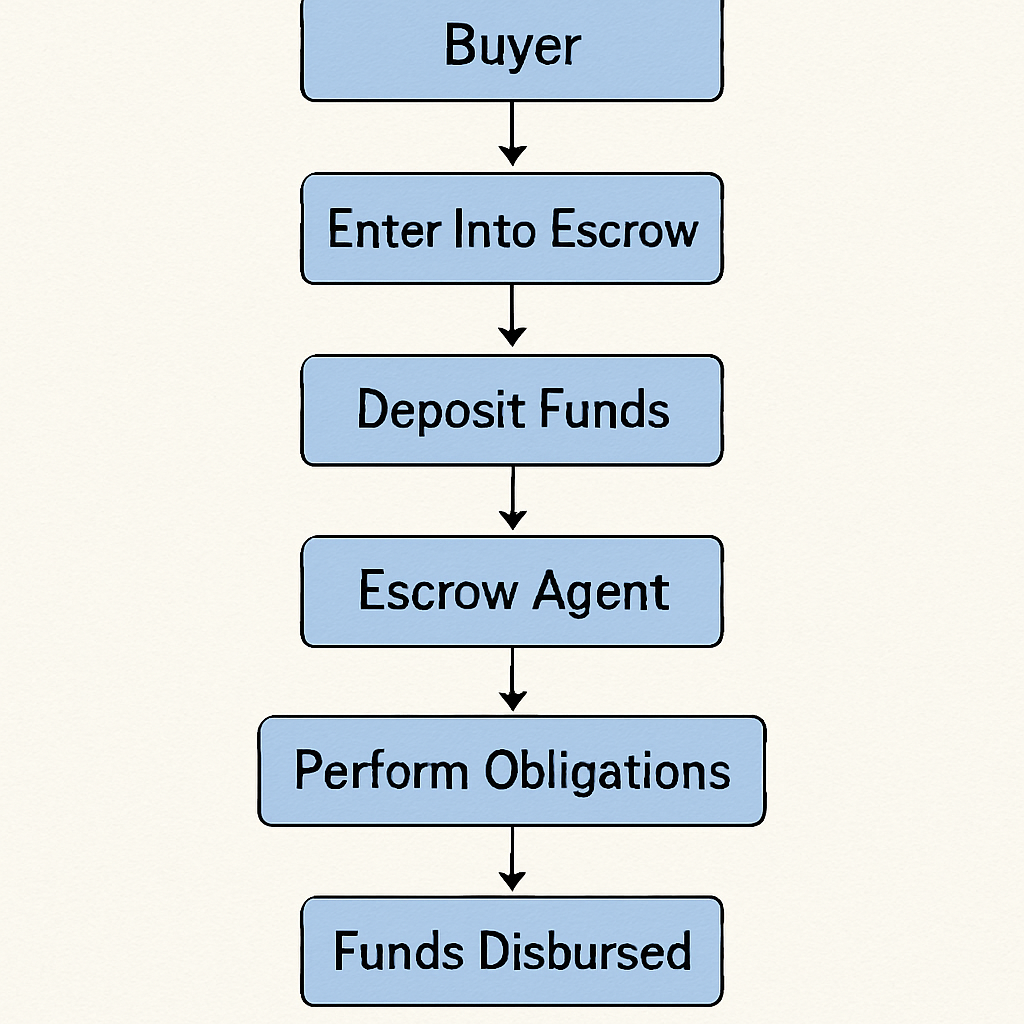

The escrow process begins when the buyer and seller agree to a transaction. This agreement outlines all necessary terms and conditions. An escrow agent is then assigned to oversee the process.

The key steps in the escrow process include:

- Opening Escrow: The buyer or seller initiates the account, often after a purchase agreement is signed.

- Depositing Funds: The buyer submits earnest money into the account to show commitment.

- Document Review: The escrow agent reviews legal documents to ensure clear property titles.

- Meeting Conditions: Both parties fulfill any conditions in the purchase agreement.

- Closing Escrow: Once all terms are met, funds are distributed and ownership is transferred.

Throughout these steps, the escrow agent ensures all parties meet their responsibilities. They also address any potential issues or disputes that arise. The escrow process guards against potential fraud, safeguarding both buyer and seller interests. By following this step-by-step approach, parties involved can confidently complete the transaction, knowing all conditions are fulfilled. LockTrust ensures each step is transparent, secure, and compliant, protecting all parties from potential fraud.

Escrow Fees and Costs

Escrow fees are a necessary expense in many transactions. They cover the services provided by the escrow agent. These fees can differ based on the transaction’s complexity and location.

Typically, escrow fees are divided between the buyer and the seller. Here’s a general breakdown:

- Fixed Fees: Often a flat rate for standard services.

- Percentage Fees: Based on the purchase price or transaction value.

- Additional Fees: May include charges for document preparation or special requirements.

These costs ensure professional handling of your transaction, providing peace of mind.

Escrow vs. Title Company in Washington State

In Washington State, an escrow company differs from a title company. Both play crucial roles in real estate but serve distinct purposes. Understanding their differences helps streamline the property transaction process.

Escrow companies manage the funds and documents between the buyer and the seller. They ensure that all transaction terms are met before the deal closes. On the other hand, title companies verify the legal ownership of the property. They ensure the title is clear of liens or claims.

Here’s a quick comparison:

- Escrow Company: Holds funds, monitors contract compliance.

- Title Company: Verifies property title, resolves liens.

Other Common Uses of Escrow Services

While escrow is well-known in real estate, its application extends far beyond property transactions. Escrow services are beneficial in various types of financial dealings, offering security and trust to all parties involved. These are some other common uses of escrow:

- Online Sales: Protects buyers and sellers by holding funds until items are received.

- Business Transactions: Ensures parties meet contractual obligations before releasing funds.

- Construction Projects: Releases payments to contractors as project milestones are achieved.

The versatility of escrow services makes them valuable in diverse transactions. Their role in ensuring compliance with terms protects all parties from potential financial loss.

Benefits of Using Escrow

Escrow services offer numerous benefits for both buyers and sellers. They play a crucial role in safeguarding transactions. Key benefits of using escrow include:

- Security: Funds are held securely until all conditions are met.

- Trust: A neutral party manages funds and documents.

- Risk Reduction: Minimizes chances of fraud and misunderstandings.

These advantages make escrow a preferred choice in many transactions, ensuring peace of mind.

Risks and How Escrow Protects Parties

Despite potential risks in transactions, escrow mitigates issues effectively. Parties involved worry less about losing money or assets. Escrow offers protections like:

- Neutral Management: Ensures fairness by involving a third party.

- Conditional Fund Release: Funds are only released when conditions are fulfilled.

These measures protect all parties, making transactions smoother and more secure.

Frequently Asked Questions About Escrow

Escrow often raises questions due to its complexity. Many people wonder how it truly benefits them. Here are some common inquiries:

- What is escrow?

- Why use escrow in real estate?

- Are escrow fees negotiable?

Understanding these points clarifies escrow’s role and its advantages in protecting both parties in a transaction.

Conclusion

Escrow plays a vital role in safeguarding transactions, providing structure, trust, and security. Whether for real estate, online sales, or business deals, escrow ensures that all parties fulfill obligations before funds or assets are released.

LockTrust escrow services simplify this process, offering peace of mind, transparency, and professional management for every transaction. Using escrow is a smart and secure choice in any complex financial exchange.